Issue #22 - What‘s possible with better data

Over the past few weeks we explored financial and commerce data, improving bank operations with better data and what corporates want from rich payments data.

In this issue, we’ll explore what’s possible with better payment data.

Next week, we’ll explore how some leading fintechs that offer bank-like services are using data to achieve remarkable results.

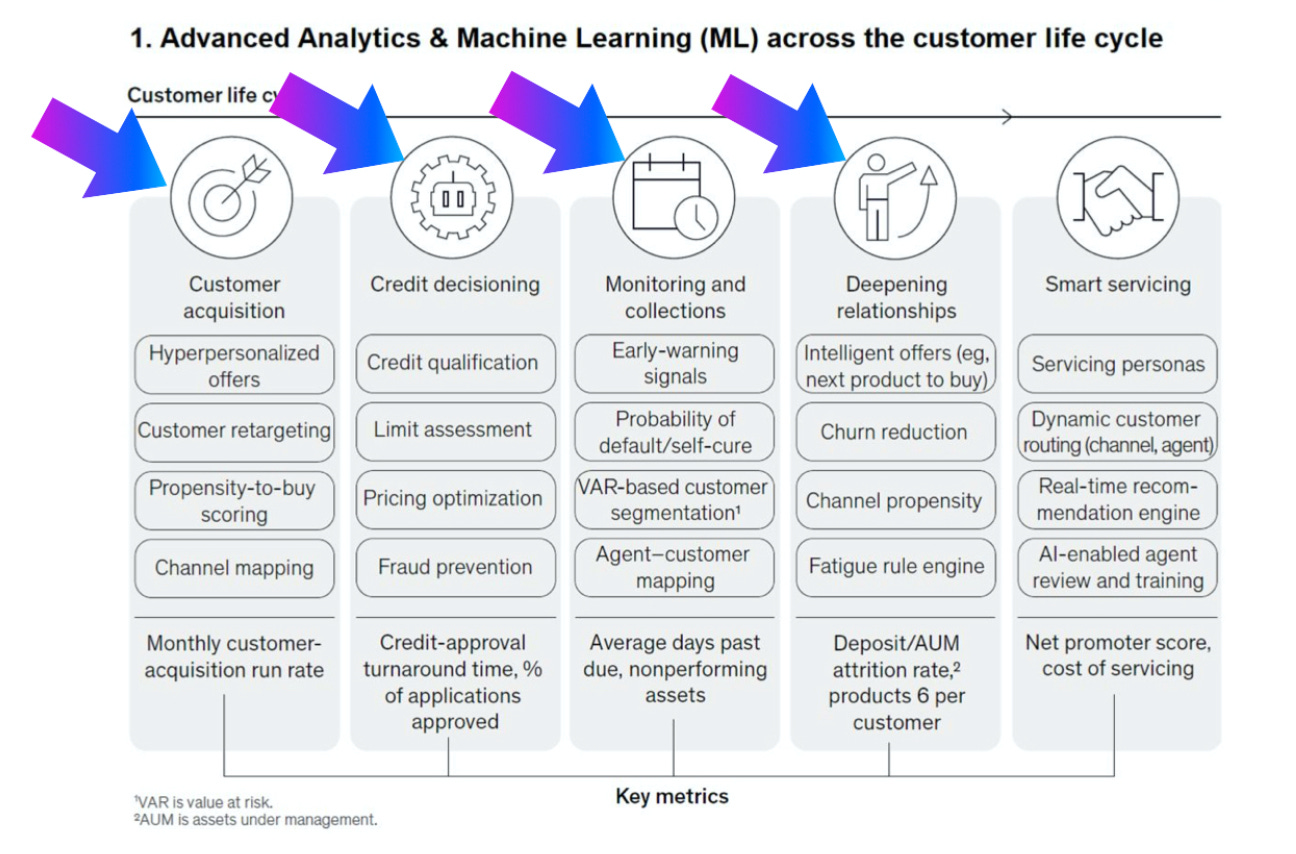

Source: McKinsey

“Payments can no longer be seen as the plumbing of the system. Bank executives need to see payments as a revenue driver — helping them better understand and listen to consumer and business needs.”

On its own, data has no inherent value, but its potential becomes obvious once it is ‘spent’.

Payments Journal: Payment Data: Is It Businesses’ Most Valuable Asset?

“By enriching traditional financial information and datasets (bank statements, tax returns, credit reports, etc.) with new sets of data related to customer’s behavior and their perception of products and services, the combination can bring numerous advantages.”

The Data Appeal Company: 5 Benefits of Alternative Data for Banks and Financial Institutions from Enriched Credit Scoring to Lead Qualification

If you have thoughts or questions to share on this series, please leave a comment.

These musings on the developments in data-rich payments are assembled by the team at 20022 Labs. See more issues and subscribe to get updates in your inbox.