Issue #25 - Are Fintechs solving corporate problems better than banks?

As mentioned last week, fintech investment has completely exploded and in our research, we found what is likely a serious driver of that investment.

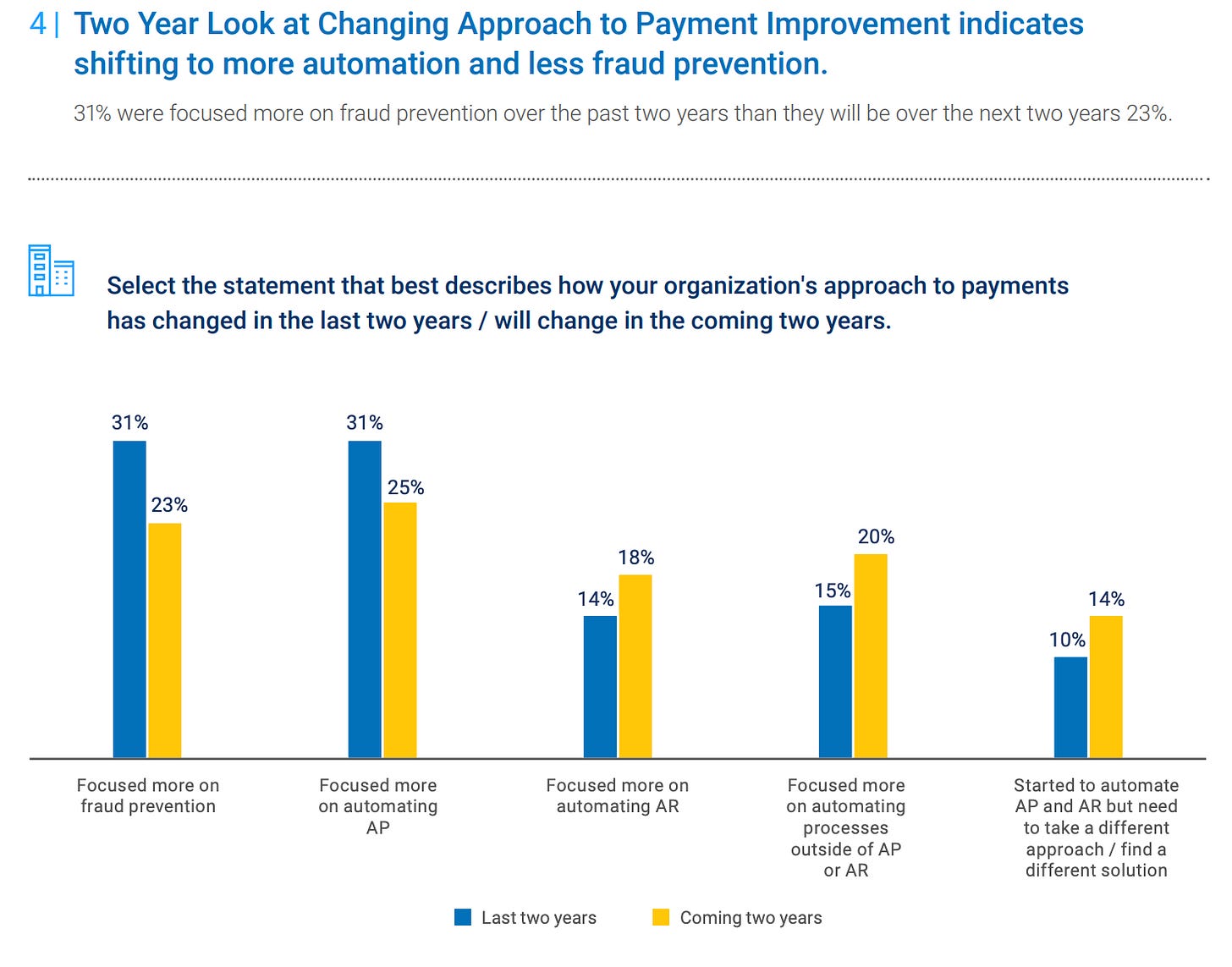

Strategic Treasurer just released its 2021 B2B Payments Survey of 300 corporate and bank executives that reported some interesting shifts in their payment improvement priorities.

A key insight we noticed is that banks and corporations are realizing what fintechs have known for years...that seamless integration between systems via APIs can address the root causes they’ve been trying to patch with AI and other half-measures.

While many payable, receivable, and payments processes have been digitized, those software systems still don’t communicate seamlessly or directly. So preparing, sending, receiving and reconciling payments still requires manual intervention leading to high processing costs, lost discounts and the largest source of fraud, vendor impersonation.

In the coming few issues, we’ll explore fintechs focused on:

Eliminating A/P processes by using spend management cards

A/P priority shifts from fraud prevention to automation

A/R challenges stem from timely payments and remittance clarity

Banks concerns with payment security are escalated

Corporate requests for B2C payments automation to manage returns and reconciliations

APIs and mobile are the banks top priorities over AI/ML.

Shoutout to Craig Jeffery and Gunita Bindra on the great survey cited in this issue.

If you have thoughts or questions to share on this series, please leave a comment.

These musings on the developments in data-rich payments are assembled by the team at 20022 Labs. See more issues and subscribe to get updates in your inbox.

Really like the angle here - we're seeing more and more how businesses are expecting their bank to integrate tightly with their other business systems to help further automate and remove data silos within A/P & A/R processes. This is exactly what the neobanks and fintechs are doing right; building platforms that allow all of a businesses financial tools to all talk with one another, creating that seamless ecosystem effect.

Super excited for the following issues where we'll see a deepdive of the fintechs out there doing exactly this particularly in the B2B payments space.